One of the most important steps in preparing products for export to Saudi Arabia via the SABER system is selecting the correct HS Code (Harmonized System Code). This code is used for customs classification, calculating duties, determining certification requirements, and assigning the appropriate Technical Regulation (TR).

Errors in HS Code selection can lead to customs delays, fines, resubmission of documents, or even a complete ban on product importation. In this article, we’ll examine the most common mistakes made by suppliers and manufacturers — and how to avoid them.

What Is an HS Code and Why Does It Matter?

An HS Code is an international commodity classification system developed by the World Customs Organization. Each product is classified using a multi-level numerical structure: the first six digits are globally standardized, while additional digits may vary by country.In Saudi Arabia, HS Codes are used for:

- Determining customs duties and VAT.

- Identifying whether mandatory certification is required.

- Linking products to the applicable Technical Regulation (TR).

- Determining additional permissions or import restrictions.

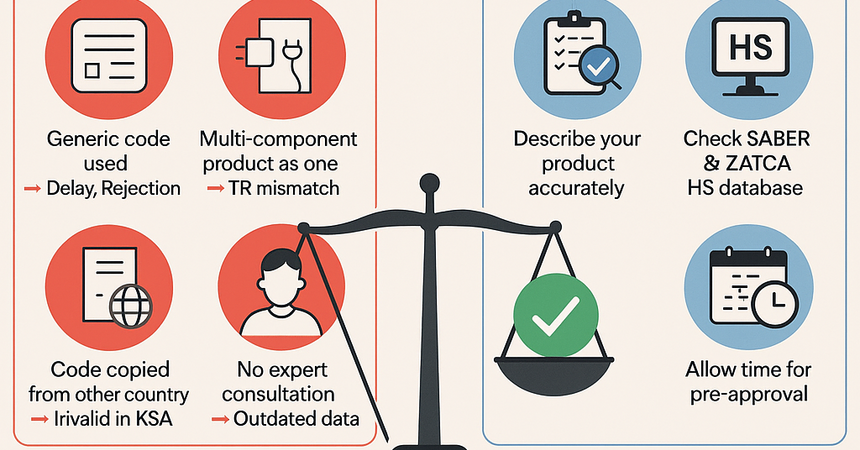

Top HS Code Selection Mistakes

Mistake 1: Using Generic or “Convenient” Codes

Some exporters choose vague codes that “roughly” match their products for simplicity. For instance, assigning a general "other electrical equipment" code to a complex device may lead to inquiries from customs or SASO requiring detailed justifications.Mistake 2: Ignoring the Complexity of Multi-Component Products

If a product includes multiple functional components (e.g., a smart lighting kit with motion sensors and remote control), some suppliers classify it as a single device. However, each part may have a distinct HS Code and fall under different technical regulations.Mistake 3: Copying HS Codes from Other Countries Without Verification

HS Codes can have country-specific extensions. A code used in the EU may differ from the Saudi version in structure or duty rates. Simply copying the code without local validation often results in errors and registration denial.Mistake 4: Skipping Consultation With Brokers or Certification Bodies

Exporters sometimes rely solely on personal experience or outdated sources. However, regulations and HS codes are regularly updated, and even experienced suppliers may make costly errors without expert advice.Consequences of Using the Wrong HS Code

An incorrect HS Code in SABER may lead to:- Denial of the Product Certificate of Conformity.

- Customs holds until the issue is corrected.

- Fines and extra charges.

- Delayed deliveries by weeks or months.

- Repeated lab testing or reassessment of the TR.

How to Avoid HS Code Mistakes

1. Conduct a Detailed Product Analysis

Carefully describe your product: functionality, materials, components, and use cases. The more precise the description, the easier it is to match with the correct code.2. Use Official Databases

Saudi Customs and the SABER system provide directories of HS Codes with local extensions. These should be checked regularly, as updates may be issued several times a year.3. Involve Professionals

Consulting customs brokers or certified bodies helps prevent errors. Experts have access to current information and practical insights that are often missed without experience.4. Allow Time for Pre-Approval

Build in extra time for code verification with regulators — it's better to confirm in advance than deal with delays and rework later.Conclusion

Choosing the correct HS Code is not just a formality — it’s a strategic step toward entering the Saudi market. Mistakes can be costly, both financially and reputationally.WorldWideBridge helps clients select the correct HS Code, verify it using local databases, prepare compliant documents, and complete SABER registration successfully. We provide full support so you can focus on your business with confidence.

Contact WorldWideBridge — we know the details and will make your export to Saudi Arabia safe, fast, and profitable.